U.S. refinery capacity sets new record as of January 1, 2020

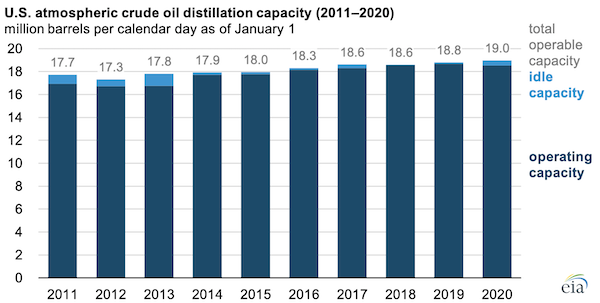

Jun 26, 2020U.S. operable atmospheric crude oil distillation capacity increased 0.9% during 2019, reaching a record of 19.0 million barrels per calendar day (b/cd), up 0.2 million b/cd from the previous record of 18.8 million b/cd the year before. According to the U.S. Energy Information Administration’s (EIA) annual Refinery Capacity Report, U.S. operable crude oil distillation unit (CDU) capacity has increased slightly in seven of the past eight years.

EIA measures refinery capacity in two ways: barrels per calendar day and barrels per stream day (b/sd). Calendar-day capacity is the operator’s estimate of the input that a distillation unit can process in a 24-hour period under usual operating conditions, recognizing the effects of both planned and unplanned maintenance.

Stream-day capacity reflects the maximum number of barrels of input that a distillation facility can process within a 24-hour period when running at full capacity under optimal crude oil and product slate conditions with no allowance for downtime. Stream-day capacity is typically about 6% higher than calendar-day capacity.

The number of operable refineries in the United States (excluding U.S. territories), which includes both idle and operating refineries, started 2019 at a total of 135. One refinery shut down in 2019: Continental Refining Company LLC’s 5,500 b/cd refinery in Somerset, Kentucky, which had been inactive since March 2018. However, Flint Hills Resources split out its reporting to EIA of the Corpus Christi East and West plants, bringing EIA’s calculation of the number of operable U.S. refineries back to 135.

The 335,000 b/cd Philadelphia Energy Solutions refinery remained in EIA’s refinery count as of January 1, but it has not operated since shortly after a fire in June 2019 damaged part of the refinery complex; a sale of the refinery is pending.

As the United States has increased crude oil production over the past decade, the average density of U.S. crude oil has become lighter. Because U.S. refineries imported less of the crude oil they processed and replaced imports with domestically produced crude oil, the average API gravity—a measure of a crude oil’s density where higher numbers mean lower density—of crude oil inputs to refineries increased. For example, the U.S. Gulf Coast, which is home to about half of U.S. refining capacity, used imported crude oil for only 28% of its crude oil inputs to refineries during 2019, down from 69% in 2010.

U.S. refineries have adapted to this changing crude oil slate by slightly increasing their yields of petroleum products that are derived from lighter crude oil, such as jet fuel, gasoline, and distillate. They have also increased their use of downstream refinery units, which are used to process the products coming from the atmospheric crude distillation unit into ultra-low sulfur diesel and gasoline as well as other products. These lighter products often have higher refining margins, a measure that represents the difference between the prices of petroleum products and crude oil.

EIA’s updated Refinery Capacity Report also includes information on capacity expansions planned for the rest of 2020. Based on information reported to EIA in the most recent update, U.S. refining capacity will not expand significantly this year.

Principal contributors: Julie Harris, Corrina Ricker

Similar Stories

New Research: 88% of high-growth companies look to tech to tackle trade challenges

View ArticleShell completes acquisition of combined-cycle power plant in priority U.S. trading market

This acquisition maintains SENA’s position in the deregulated Independent System Operator New England (ISO New England) power market, securing long-term supply and capacity offtake for Shell. In the coming decades,…

View ArticleWorksport Ltd. ($WKSP) announces Global Patent Portfolio Growth, and joins LOT Network for enhanced patent protection

Worksport is proud to announce a ~25% growth in its global patent portfolio, encompassing both issued patents and pending patent applications. This expansion reflects Worksport’s commitment to addressing real-world customer…

View Article

Today in Energy: New solar plants expected to support most U.S. electric generation growth

View ArticleMatson announces quarterly dividend of $0.34 per share

The Board of Directors of Matson, Inc. (NYSE: MATX), a leading U.S. carrier in the Pacific, today declared a first quarter dividend of $0.34 per common share. The dividend will…

View Article

Alleima receives an order for mass production of fuel cells from Doosan Fuel Cell

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!