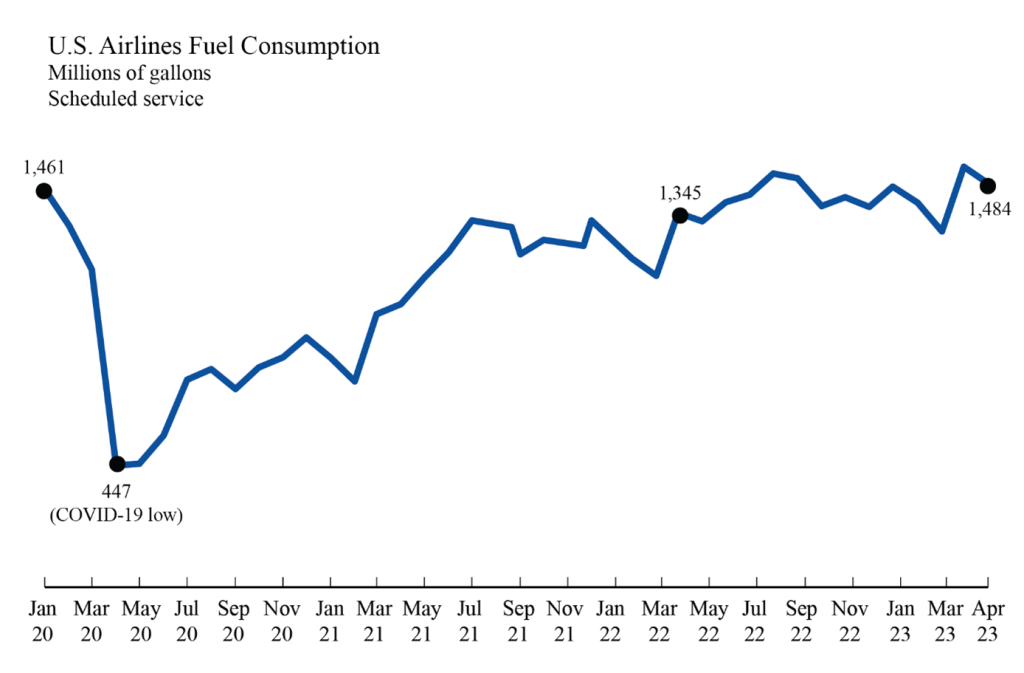

U.S. airlines’ fuel consumption in April 2023 returned to its pre-pandemic level.

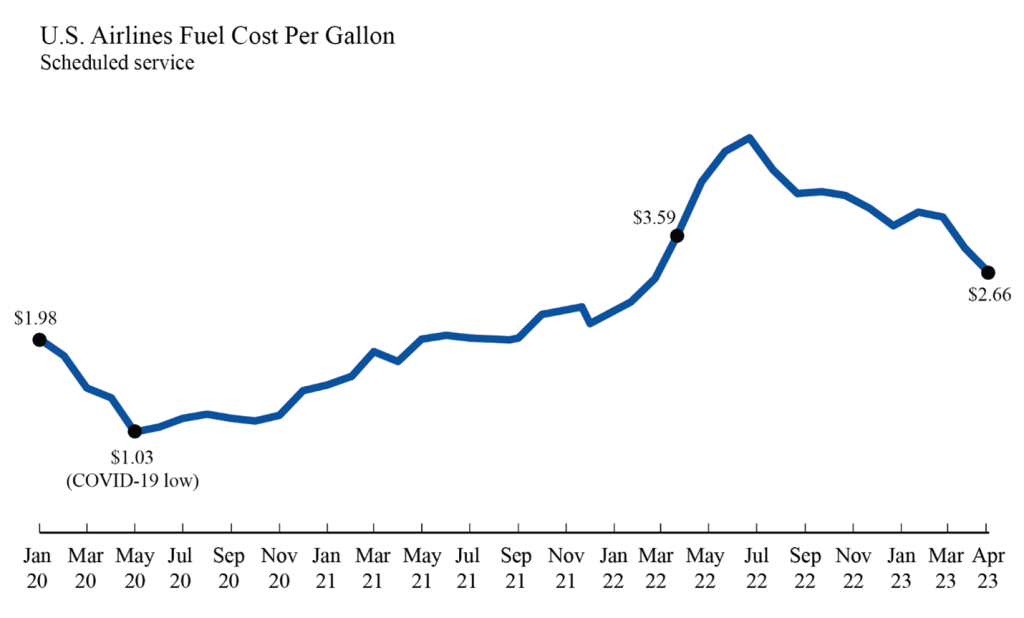

Jun 02, 2023The Department of Transportation’s Bureau of Transportation Statistics (BTS) today released U.S. airlines’ April 2023 fuel cost and consumption numbers indicating U.S. scheduled service airlines used 1.484 billion gallons of fuel, 3.9% less fuel than in March 2023 (1.545 billion gallons) and 0.1% less than in pre-pandemic April 2019. The cost per gallon of fuel in April 2023 ($2.66) was down 26 cents (8.8%) from March 2023 ($2.91) and up $0.60 (29.3%) from April 2019. Total April 2023 fuel expenditure ($3.94B) was down 12.4% from March 2023 ($4.50B) and up 29.1% from pre-pandemic April 2019.

Year-over-year changes in fuel consumption and cost for April 2023 include 6.8% increase in domestic fuel consumption, 20.6% decrease in domestic fuel cost, and 25.6% decrease in cost per gallon. Domestic fuel consumption decreased 6.4% from March 2023 to April 2023, while increasing 0.5% from April 2019. Increased fuel consumption reflects an increase in airline passenger travel over the same period.

Fuel consumed by U.S. airlines (total) scheduled service:

April 2019: 1.49 billion gallons

April 2022: 1.35 billion gallons

March 2023: 1.55 billion gallons

April 2023: 1.48 billion gallons

Fuel cost per gallon for U.S. airlines (total) scheduled service:

April 2019: $2.06

April 2022: $3.59

March 2023: $2.91

April 2023: $2.66

Total fuel cost for U.S. airlines (total) scheduled service:

April 2019: $3.06 billion

April 2022: $4.82 billion

March 2023: $4.50 billion

April 2023: $3.94 billion

Fuel Cost and Consumption data from March 2000 to the present can be found at https://transtats.bts.gov/fuel.... Summaries by month are also available.

Airline fuel costs may be affected by hedging, contracts that allow airlines to limit exposure to future price changes.

Individual airline numbers through December 2022 are available on the BTS website.

Please Note:

The information provided within BTS statistical releases may not be based on 100% of reporting carriers. Generally, data are released per schedule if reports have been received from at least 90% of the carriers, along with data from all the major carriers. Regarding this release, the following carriers remain pending: Elite Airways (2HQ). Also, within text, percent change results may not be exact due to rounding.

Similar Stories

Lufthansa Cargo and Maersk launch cooperation to support decarbonization of airfreight

View ArticlePort Authority of New York and New Jersey airports see spookily spectacular surge in October

Port of New York and New Jersey surpasses 700,000 TEUs for eighth consecutive month

View Article

airBaltic Cargo partners with cargo.one to accelerate and enhance its digital sales

View Article

Chapman Freeborn agrees partnership with Portuguese multimodal logistics specialist

View Article

Cathay is ready for the commissioning of the three-runway system at Hong Kong International Airport

View ArticleUnited Airlines Holdings Inc. upgraded To ‘BB’; outlook stable

• United Airlines Holdings Inc. is on track to generate credit measures in line with our previous upside rating threshold this year, and we expect improvement in 2025. • The…

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!