Two of Rystad Energy’s analysts adding comments on the WTI collapse:

Apr 20, 2020From Louise Dickson, Oil Market Analyst:

The intraday WTI destruction today is certainly epic in scale, which is largely a case of jitters ahead of the WTI May 2020 futures contract expiring tomorrow and storage fears finally materializing. But if you have been watching the physical spot prices in the North Sea, currently trading in the $15-18 range, this drop in WTI May 2020 futures isn’t as shocking.

From Bjornar Tonhaugen, Head of Oil Markets:

The extreme oversupply situation now in April and expected into May is creating huge dislocations for the May 2020 WTI NYMEX contract today in low traded volumes, because the contract has its last trading day tomorrow 21 April on NYMEX. There is probably a squeeze happening right now, while the remaining 21 million barrels of Cushing storage is likely to be filled up into May 2020 at the current pace of stock builds, causing further panic and collapse in the “spot price” for Cushing WTI in low liquidity.

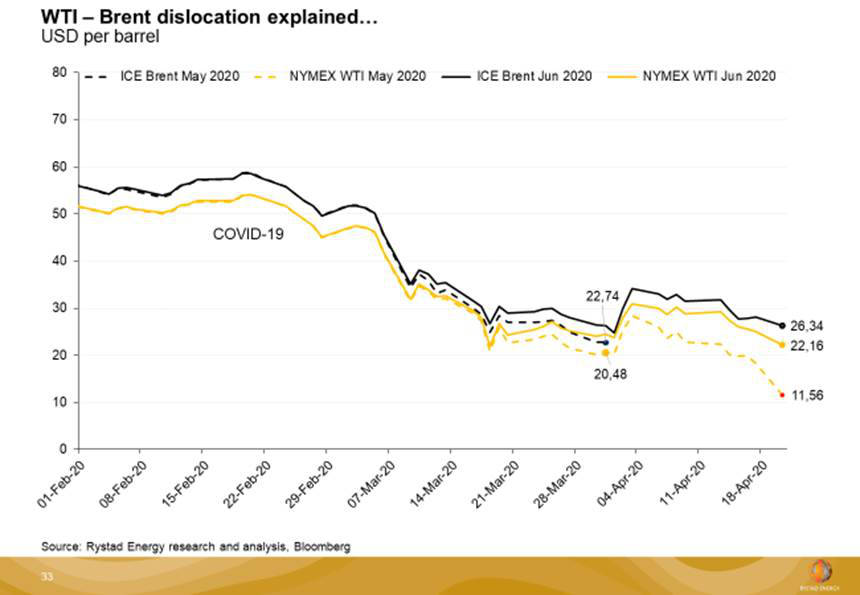

Because the market is severely oversupplied, it at first glance appears as though the WTI-Brent spread also is collapsing, but here it is important to talk about the correct prices and comparisons. Because the Brent futures contract rolls over to the next calendar month (now June 2020) several weeks earlier than the NYMEX WTI front month (still May 2020 delivery!) the “correct” WTI-Brent spread to look at based on the futures trading is now the June 2020 spread. This is more normal around -4 USD/bbl.. The ICE Brent futures contracts rolls on the last calendar day of the month normally (so Brent May 2020 stopped trading on 31 March).

The more accurate WTI-Brent spread to look at now for the prompt (May delivery) would be the physical prices in the North Sea vs. the May 2020 NYMEX WTI. Physical North Sea Dated is trading in the vicinity of 16-17 USD/bbl, so the WTI-Brent spread for “May” is closer to the -4/-5 right now it seems, not -15 USD/bbl which you can get an impression from only looking at the futures prices on the screens now.

Similar Stories

FTR Reports U.S. trailer net orders in December at 25,334 units, the most since October 2023

Total trailer production declined 10% m/m in December to 11,827 units, a relatively typical seasonal drop. However, production was down 40% y/y – 43% below the five-year December average –…

View Article

2024 marks record air cargo year for Vienna Airport

View Article

Today in Energy: A look back at our forecast for global crude oil prices in 2024

View Article

WorldACD Weekly Air Cargo Trends (week 2) - 2025

View ArticleDaphne Technology and Williams secure DOE grant to advance methane emission reduction technology

Daphne Technology, in partnership with Williams, has announced the award of a grant worth nearly $6M from the U.S. Department of Energy's (DOE) Methane Emissions Reduction Program (MERP).

View Article

Solar Prize Round 8 semifinalists & power up contest winners

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!