Schiphol Airport weathers global cargo decline

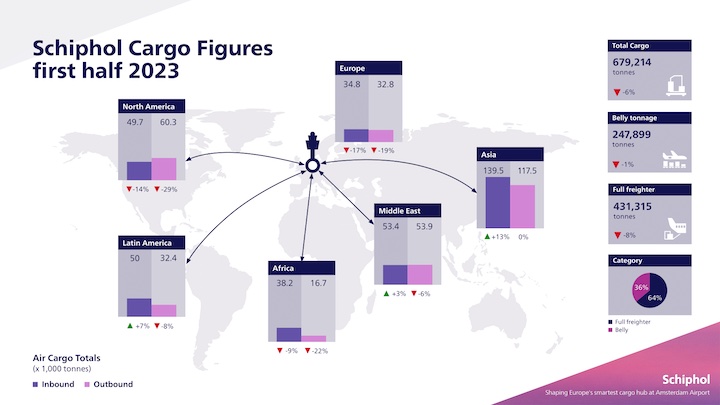

Sep 14, 2023Amsterdam Airport Schiphol processed 679,214 tonnes of cargo in the first six months of 2023, a dip of 6 percent compared with the same period in 2022, in-keeping with global trends for normalizing cargo volumes following months of ongoing decline.

Full freighter flights accounted for 64 percent of total throughput at the airport, equating to 431,315 tonnes of cargo.

“When you compare our figures to the wider picture across Europe, you’ll find that Schiphol Airport has weathered global challenges quite well,” said Joost van Doesburg, Head of Cargo, Royal Schiphol Group.

“According to IATA, the total air cargo market in Europe saw a 10.2 percent decrease – here at Schiphol, we had a significantly lower drop of 6 percent.”

Of the total cargo volumes in the first half of 2023, 247,899 tonnes comprised belly cargo, representing 36 percent of all cargo processed, and a 1 percent drop compared with half-one (H1) 2022.

Schiphol Airport’s inbound cargo volumes saw an overall increase on certain trade lanes in H1 2023, with cargo inbound from Asia up 13 percent compared with H1 2022, volumes from the Middle East up by 3 percent, and cargo arriving from Latin America up by 7 percent.

“Schiphol’s Q2 figures show that Amsterdam Airport Schiphol is still a key gateway into Europe for air cargo and, despite a difficult period for the global industry, we are starting to see our volumes stabilize,” added van Doesburg.

“More freighters would like to fly to Schiphol, but our slots are full, and ad-hoc slots have decreased significantly compared to last year – this is the biggest factor behind the tonnage loss.

“However, our limited freight slots have also driven us to become more stable than other European hubs, shifting our focus to streamlining and focusing our operations.”

Looking at the statistics by quarter, cargo transported by passenger flights in the second quarter of 2023 increased by 0.6 percent compared to the same quarter in 2022.

Cargo transported by passenger flights decreased by 26.9 percent between April and June 2023 compared to the pre-Covid Q2 in 2019, owing to fewer flights and lower cargo volumes.

The total amount of full freighter flights in Q2 was 9.0 percent lower than last year, but 17.8 percent higher than in 2019.

“We remain focused on air cargo and are planning measures to secure freighter slots to ensure they cannot be swapped into passenger slots,” added van Doesburg.

“We continue to work together with the Dutch air cargo community and invest heavily in our new Port Community System to make it state of the art as we look to become an efficient multimodal hub for European cargo, focusing on quality over quantity.”

Amsterdam Airport Schiphol recently signed up to new online information portal, Secure Import, aimed at tightening cargo security in and around the hub, and is developing a fully automated cargo centre, dnata Cargo City Amsterdam, due to launch in 2024.

Similar Stories

JAS Worldwide signs SPA with International Airfreight Associates B.V.

JAS Worldwide, a global leader in logistics and supply chain solutions, and International Airfreight Associates (IAA) B.V., a prominent provider of comprehensive Air and Ocean freight services headquartered in the…

View Article

LATAM is once again part of the Dow Jones Sustainability Index

View Article

CPaT partners with Wizz Air, Europe’s leading ultra-low-cost airline, to enhance aviation training

View Article

Air Transat takes off to Tulum from Montreal and Quebec City

View Article

Air France KLM Martinair Cargo achieves record online sales and accelerates commercial transformation

View Article[Freightos Weekly Update] Frontloading continues to put pressure on transpacific rates

Transpacific ocean rates increased slightly last week and are about 15% higher than at the start of December as frontloading ahead of expected tariffs is keeping vessels full.

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!