Rystad: Energy transition could push oil majors to sell or swap oil and gas assets of more than $100 billion

Sep 22, 2020The global energy market is on the brink of a major transition to cleaner sources of energy. To adjust and transform, the world’s largest oil and gas firms are revising their long-term oil price and demand outlook, and need to streamline their portfolios significantly to improve cash flow, cost efficiency and competitiveness. As a result, several billions of dollars in assets are about to change hands.

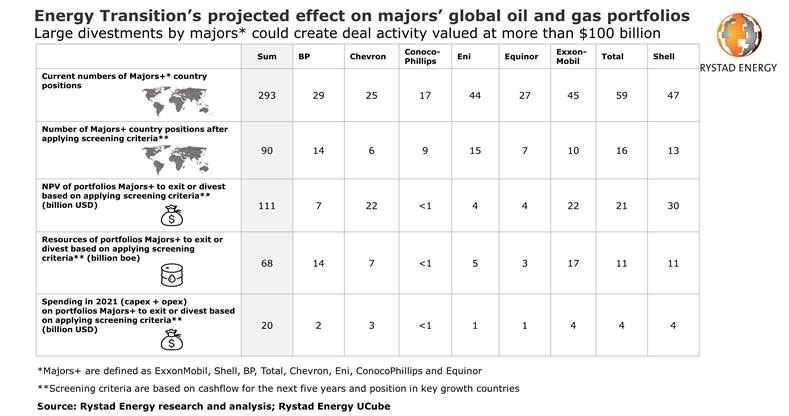

A Rystad Energy study of the geographical spread of ExxonMobil, BP, Shell, Total, Eni, Chevron, ConocoPhillips and Equinor – which we call “Majors+” – reveals that to adjust to the energy transition, the eight companies may need to divest combined resources of up to 68 billion barrels of oil equivalent, with an estimated value of $111 billion and spending commitments in 2021 totaling $20 billion.

Our key criteria for determining whether a Major+ would benefit from staying in a country are the company’s cash flow over the next five years, the potential growth in its current portfolio, and its presence in key E&P growth countries towards 2030. Based on this we see that the Majors+ may seek to exit 203 country positions and as a result reduce their number of country positions from 293 to 90.

“Companies will look to expand in the prioritized countries through exploration, acquisitions or asset swaps with other Major+ players. However, to stay in a country that our criteria exclude, a company may instead seek to grow its local business more aggressively to make sure the portfolio will have a positive and more significant impact on overall performance,“ says Rystad Energy’s Senior Vice President Tore Guldbrandsoy.

Based on our criteria, we see that the Majors+ altogether need to exit 203 country positions in 60 countries. The remaining countries after the screening vary from six to 16 countries per company.

Rystad Energy’s study shows that all the Majors+ companies are likely to keep a presence in the US, and most of them may also remain in Australia and Canada. On the other end of the scale we see quite a few countries with only one oil major present, including Argentina (BP), Ghana (Eni), Thailand (Chevron) and Guyana (ExxonMobil). In some of these countries it could be tempting for others to stay or increase their presence as the competition may be more limited. At the same time, these countries could also be growth targets for other companies than the Majors+.

The results of the study, which are not fully disclosed in this press release, indicate a number of potential deals among Major+ players buying portfolios from each other to boost their position in a key country.

For example, BP, Eni and ConocoPhillips could consider acquiring the Indonesian portfolios of ExxonMobil, Total and Shell. Shell’s and Total’s portfolios could be of interest to BP if the UK-based company wants to enlarge its Indonesian LNG asset base and take on a new growth asset.

A further analysis of other parameters of the portfolios, like hydrocarbon type, supply segment, size and asset location, will help identify the best acquisition target for each region. Indonesia is clearly a place to stay for gas assets, with a mixture of onshore, offshore shelf and deepwater assets across all lifecycles – but a company’s portfolio needs to be material over the longer term.

In recent months we have seen that the Majors+ are already putting larger portfolios up for sale, like ExxonMobil, which is planning several country exits including the UK, Romania and Indonesia, and Shell which was trying to exit a key LNG asset in Indonesia in 2019. This shows that the Majors+ are well aware of the need to focus their portfolios to improve cashflow, efficiency and competitiveness as the energy transition accelerates – but so far, the steps may be too small.

The current market situation means that the cash available for acquisitions could be limited, and price volatility could make it difficult for buyers and sellers to agree on a valuation. An alternative way for the Majors+ companies to exit some countries and grow in others could be to do swaps between country portfolios. This could include two or more countries to align values and reduce the cash element of a deal.

We see several such opportunities: For instance, BP could swap its position in Algeria for Eni’s holdings in Australia. As BP’s Algerian portfolio is valued at around $320 million and Eni’s Australian portfolio at about $466 million, the companies would have to find additional conditions to even out a swap. Another example could be Shell swapping its assets in Norway for Total’s portfolio in Oman.

We also expect that the Majors+ will divest assets with high emission intensity to meet long-term targets for reducing emissions, however this consideration is not included in this study.

This article does not necessarily reflect the opinion of the AJOT editorial board or Fleur de lis Publishing, Inc. and its owners.

Similar Stories

U.S. Department of Energy: $20.2 million in projects to advance development of mixed algae for biofuels and bioproducts

View Article

New funding propels Pier Wind at Port of Long Beach

View Article

Most U.S. petroleum coke is exported

View Article

Paired Power installs two PairTree solar EV chargers at the Port of Hueneme

View Article

KR, HD KSOE, HD HHI, KSS Line, and Liberian Registry partner to develop safety guidelines for ship-to-ship ammonia bunkering

View Article

U.S. associated natural gas production increased nearly 8% in 2023

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!