Russian markets dive as U.S. plans sanctions on sovereign bonds

Russian bonds sank the most since March last year and the ruble tumbled as the U.S. prepared to unveil sanctions on the nation’s local debt, a threat that has dimmed investor appetite for the market for years.

The yield on ruble debt due in 10 years jumped the most since the peak of the pandemic-driven market turmoil. Stocks snapped three days of gains and the Russian currency dropped the most since December, erasing a rally spurred earlier in the week by U.S. President Joe Biden’s proposal for a summit with Vladimir Putin.

The planned measures include barring U.S. financial institutions from participating in the primary market for new debt issued by the Russian central bank, Finance Ministry and sovereign wealth fund, according to a person familiar with the package of sanctions expected to be announced this week. The precise timing of the bond measures wasn’t clear, they said.

Penalties on government OFZ bonds would be “something new for the market,” said Iskander Lutsko, a strategist at ITI Capital in Moscow. “A recovery will depend on how the Russian authorities react—if it’s muted, then markets will claw back ground, but if the planned meeting with Biden is canceled and there’s tough rhetoric, then the pressure will only increase.”

Once seen as too big a risk for markets, the bond sanctions are becoming a reality after Russia’s troop buildup on the border with Ukraine sent tensions with the West spiraling. Penalties focusing on Russian individuals and entities could be announced as early as Thursday and come in retaliation for alleged Kremlin misconduct including the SolarWinds hack and efforts to disrupt the U.S. election.

Analysts at JP Morgan Chase & Co. downgraded the ruble and Russian bonds last week, citing the escalating tensions and the risk that U.S. investors might close long positions on OFZs.

Russian officials say bond sanctions wouldn’t cause much damage to Russia’s financial markets because local banks and non-U.S. investors would step in to replace those forced to sell. A move to ban U.S. banks from buying new issues of Russian Eurobonds in 2019 did little to dent the Kremlin’s access to foreign funding.

VTB Bank PJSC bought more than 70% of the local notes on offer in debt sales on Wednesday, which saw a record placement equivalent to almost $3 billion.

State Backup

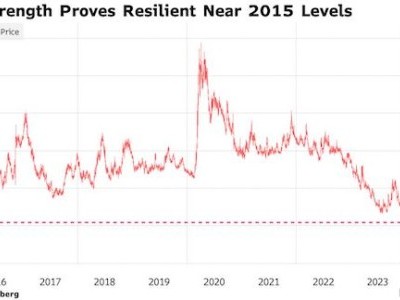

“It is OFZ- and ruble-negative in the near-term,” ING Groep NV economist Dmitry Dolgin said from Moscow. “The market has been speculating on the likelihood of that for a couple of years, and since mid-2020 the perceived risk of sanctions went up, and the ruble’s discount to its emerging-market and commodity-producing peers doubled.”

After climbing 27 basis points at the start of trading, yields on Russia’s 10-year ruble bonds were up 19 basis points at 7.23% as of 11:21 a.m. in Moscow, set for the biggest increase since August. The ruble traded 1.3% weaker at 76.85 per dollar, after a drop of as much as 2.1%. Russia’s benchmark MOEX stock index snapped three days of gains with a 0.8% retreat.

On Thursday, investors were waiting for further details of the planned restrictions.

Which institutions are covered by the sanctions may be key, especially if it affects the world’s biggest bond clearing systems, according to Paul McNamara, an emerging-markets investor at GAM Investments in London.

“Does that include any financial institution with a U.S. operation? Or, conceivably, U.S. clients,” he said. “If it affects Euroclear and Clearstream that’s a bigger deal, but most OFZs don’t go via those systems, even held by foreigner.”

Similar Stories

China state media warns of retaliation on EU subsidy probes

China is prepared to take countermeasures against the European Union if it continues a series of anti-subsidy investigations into Chinese companies, according to a post on a state-media affiliated social…

View Article

Contraband turtle skulls, crocodile skins, kangaroo meat, exotic butterflies seized by CBP and FWS at LAX

View Article

Chinese-made Teslas pour into Canada as Biden erects US tariff wall

View Article

Multinationals are seeking protection against Mexican ‘super peso’

View Article

NASDA commends progress on farm bill development and continues advocating for bipartisanship

View ArticleChina processed less crude oil with apparent demand fall most

China processed a lower volume of crude in April as refiners shut operations to conduct planned seasonal maintenance.

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!