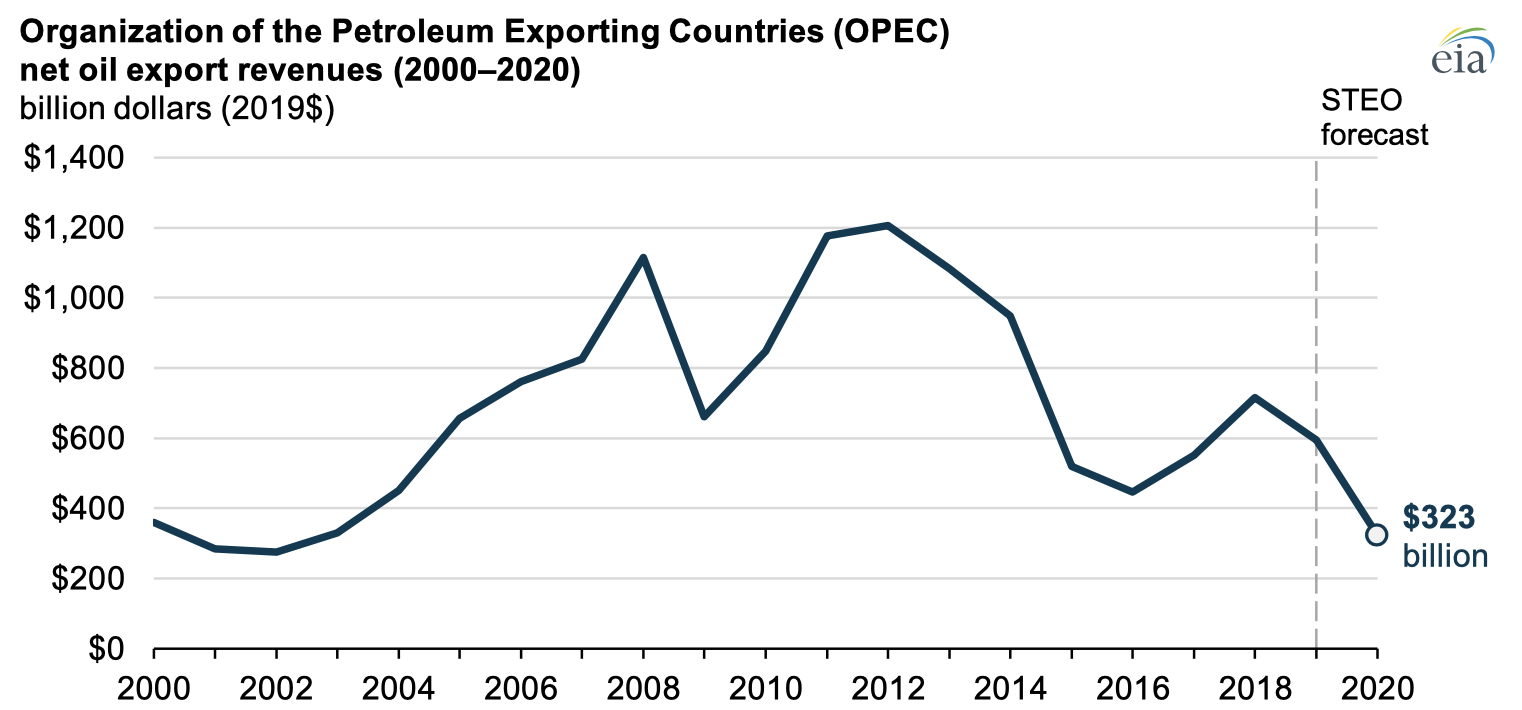

OPEC members’ net oil export revenue in 2020 expected to drop to lowest level since 2002

Nov 03, 2020The U.S. Energy Information Administration (EIA) forecasts that members of the Organization of the Petroleum Exporting Countries (OPEC) will earn about $323 billion in net oil export revenues in 2020. If realized, this forecast revenue would be the lowest in 18 years. Lower crude oil prices and lower export volumes drive this expected decrease in export revenues.

Crude oil prices have fallen as a result of lower global demand for petroleum products because of responses to COVID-19. Export volumes have also decreased under OPEC agreements limiting crude oil output that were made in response to low crude oil prices and record-high production disruptions in Libya, Iran, and to a lesser extent, Venezuela.

OPEC earned an estimated $595 billion in net oil export revenues in 2019, less than half of the estimated record high of $1.2 trillion, which was earned in 2012. Continued declines in revenue in 2020 could be detrimental to member countries’ fiscal budgets, which rely heavily on revenues from oil sales to import goods, fund social programs, and support public services. EIA expects a decline in net oil export revenue for OPEC in 2020 because of continued voluntary curtailments and low crude oil prices.

The benchmark Brent crude oil spot price fell from an annual average of $71 per barrel (b) in 2018 to $64/b in 2019. EIA expects Brent to average $41/b in 2020, based on forecasts in EIA’s October 2020 Short-Term Energy Outlook (STEO). OPEC petroleum production averaged 36.6 million barrels per day (b/d) in 2018 and fell to 34.5 million b/d in 2019; EIA expects OPEC production to decline a further 3.9 million b/d to average 30.7 million b/d in 2020.

EIA based its OPEC revenues estimate on forecast petroleum liquids production—including crude oil, condensate, and natural gas plant liquids—and forecast values of OPEC petroleum consumption and crude oil prices.

Principal contributors: Matt French, Bill Brown, Natalie Kempkey

Similar Stories

New interagency study finds expansion of renewable energy production on federal lands could power millions more American homes

View ArticleEIA Short-Term Energy Outlook

This edition of our STEO is the first to include forecasts for 2026.

View Article

EIA publishes its first energy-sector forecasts through 2026

View Article

WorldACD Weekly Air Cargo Trends (week 1)

View Article

The eighth U.S. liquefied natural gas export terminal, Plaquemines LNG, ships first cargo

View Article

Is 2025 the year when pressure finally gives way? - Rystad Energy’s Oil Market Update

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!