North American transborder freight data, July 2020

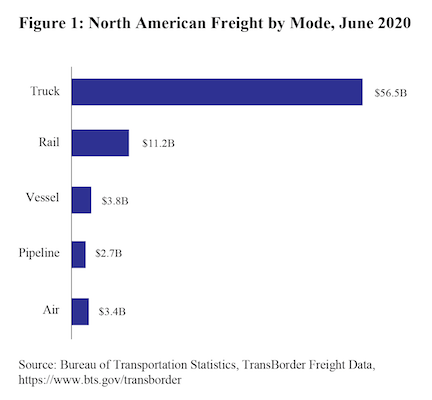

Sep 15, 2020The release summarizes the monthly value of freight transported by truck, rail and other modes between the U.S. and Canada and the U.S. and Mexico with the top states, ports and commodities. Previously, BTS reported that the value of total Transborder freight in June 2020 was $82 billion, down 21% compared to June 2019 and up 46% from May 2020.

Air Travel Consumer Report: June 2020 Numbers

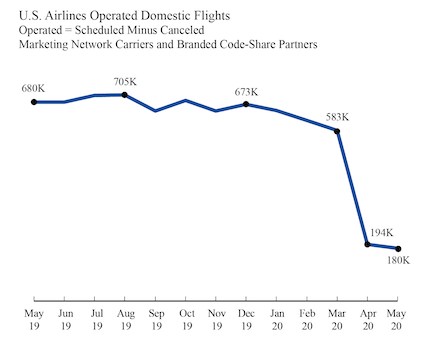

This release consists on U.S. airline domestic monthly on-time performance, cancellations, tarmac data, mishandled baggage released in coordination with the Department of Transportation’s release of the Air Travel Consumer Report. From the previous month’s release, the 10 reporting marketing network carriers reported 192,412 scheduled domestic flights in May 2020 compared to 331,238 flights in April 2020 and 694,331 flights in May 2019. Of those 192,412 scheduled flights, 6.4%, 12,261 flights, were canceled. As a result of schedule reductions and cancellations, the carriers reported operating an all-time monthly low of 180,151 flights in May 2020, compared to 194,390 flights in April 2020 and the previous low of 370,027 in February 1994. The marketing carriers include branded code-share partners of mainline carriers.

International Air Cargo, July 2020 (Preliminary)

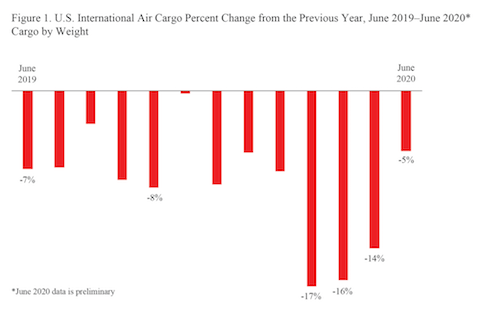

The release provides the year-to-year percent change by month from 2016 through July 2020 in the total weight of air cargo between the U.S. and foreign points. It also shows the percent change for cargo between the U.S. and the different regions of the world – Europe, Latin America, Asia. Finally, it shows the percent change in cargo between the U.S. and China and he U.S. and Canada. From the previous release, airlines carried 5% less cargo by weight between the U.S. and foreign points in June 2020 than in June 2019.

Similar Stories

JAS Worldwide signs SPA with International Airfreight Associates B.V.

JAS Worldwide, a global leader in logistics and supply chain solutions, and International Airfreight Associates (IAA) B.V., a prominent provider of comprehensive Air and Ocean freight services headquartered in the…

View Article

LATAM is once again part of the Dow Jones Sustainability Index

View Article

CPaT partners with Wizz Air, Europe’s leading ultra-low-cost airline, to enhance aviation training

View Article

Air Transat takes off to Tulum from Montreal and Quebec City

View Article

Air France KLM Martinair Cargo achieves record online sales and accelerates commercial transformation

View Article[Freightos Weekly Update] Frontloading continues to put pressure on transpacific rates

Transpacific ocean rates increased slightly last week and are about 15% higher than at the start of December as frontloading ahead of expected tariffs is keeping vessels full.

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!