Japan’s energy policies aim for increased zero-carbon electricity generation

May 02, 2024

Over the last several years, the Japanese government has announced energy policies aimed to achieve carbon neutrality, or net-zero greenhouse gas (GHG) emissions, by 2050 by lowering emissions in the electric power, industrial, and transportation sectors. In the electric power sector, government policies set 2030 targets, which include accelerated investment in renewable capacity, increased use of nuclear generation, and reduced use of fossil fuels for electricity generation. Japan’s government called the package of energy policies and their targets “ambitious.” Energy security considerations may affect the progress and pace of decarbonization in the electric power sector.

Below, we examine policies affecting generation from non-fossil fuel sources, namely renewable sources and nuclear generation in the first part of a two-part series on Japan’s energy policies in the electric power sector. A second part will discuss policies affecting generation from fossil fuels, including liquefied natural gas, coal, and petroleum.

Electric power sector policies

Japan’s 6th Strategic Energy Plan (released in 2021) and the GX (Green Transformation) Decarbonization Power Supply Bill (released in 2023) target increasing the share of non-fossil fuel generation sources to 59% of the generation mix by 2030 compared with 31% in 2022. Policies target an increase in the share of renewable generation sources including solar, wind, hydropower, geothermal, and biomass from 26% in 2022 to 36%–38% by 2030 and an increase in the share of nuclear generation from 5% in 2022 to 20%–22% by 2030.

Generation by fossil fuels (natural gas, coal, and petroleum) is set to decline from 69% in 2022 to 41% by 2030. The policies also could expand hydrogen and ammonia use in natural gas and coal co-fired power generation, in difficult-to-electrify end-use sectors, and in advanced carbon capture and storage technology development.

Renewable energy resources

From 2018 to 2022, the share of renewable generation in Japan grew from 21% to 26%. Policies to increase its share are to be supported by:

• Establishing renewable energy promotion zones (zones that meet specific criteria for developing renewable energy projects and that provide investment and licensing benefits)

• Increasing investments in research and development focused on technology advancements, particularly in solar and wind

• Accelerating development of offshore wind projects

• Stimulating growth in the renewable capacity buildout through other initiatives

The targeted increase in renewable generation is paired with broad encouragement of battery storage. According to Japan’s 6th Strategic Energy Plan, battery storage will be increased as a distributed source of electricity closer to end users and within microgrids.

This new policy calls for an increase in installed solar capacity from 79 gigawatts (GW) in 2022 to 108 GW by 2030. Initiatives include installing solar capacity on 50% of government buildings (6 GW), on corporate buildings and parking garages (10 GW), and on public land and promotion areas (4 GW). The targeted increase in Japan’s wind capacity focuses on increasing offshore capacity from 0.14 GW in 2022 to 10 GW by 2030. In March 2024, the Japanese government approved a draft amendment to allow offshore wind turbines to be installed in Japan’s exclusive economic zone.

Nuclear power

From 2018 to 2022, the share of nuclear generation remained at about 5% of total generation in Japan. Lawmakers approved the GX Decarbonization Power Supply Bill, which effectively maintains existing legal provisions that allow nuclear reactors to operate beyond the 40-year license to 60 years of operation. The bill also designated nuclear power as a main component of the country’s baseload electricity generation. Japan also intends to maximize the use of existing reactors by restarting as many units as possible.

Japan’s government has encouraged a collaborative effort between manufacturers and electric utilities to develop next-generation reactors, signaling a sustained role for nuclear power in Japan’s electricity mix.

Before 2011, nuclear power accounted for about 30% of Japan’s electricity mix, and the government had planned to increase that share to over 40% by 2017. After the 2011 Fukushima Daiichi accident, the Japanese government suspended operation of all nuclear reactors for mandatory inspections and safety upgrades. The reactors were systematically taken offline during planned refueling and maintenance outages; the last two units were suspended in 2013.

Nuclear restarts have proceeded slowly since the first two units were restarted in 2015. This hesitancy reflects, among other factors, continued public safety concerns, local court injunctions, comprehensive safety inspections, and lengthy authorization processes within changing regulatory requirements.

Japan has restarted 12 reactors and expects to restart two more units in 2024. Chugoku Electric Power Company announced that it will restart Shimane Unit 2 at its facility in the Matsue Prefecture in August. Tohoku Electric Power has announced plans to restart Onagawa Unit 2 in the Miyagi Prefecture of northeastern Japan in September.

We estimate that 24 GW of operating nuclear capacity will be required for nuclear generation to meet the policy target of 20% to 22% of total generation by 2030. By the end of 2024, a total of 12.6 GW of nuclear generating capacity is expected to be operating. An additional 11.4 GW of nuclear capacity will need to be restarted between 2025 and 2030 to meet the policy target.

Similar Stories

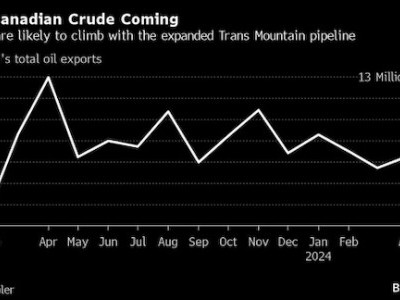

Red Sea disruption is splitting global LNG trade in regions

View Article

One oil cargo’s odd journey highlights a global market in flux

View Article

Biden-Harris Administration celebrates progress in domestic floating offshore wind

View ArticleEngine Technology Forum calls on House leaders to prioritize action on the Diesel Emissions Reduction Act

The Engine Technology Forum issued the following statement from Executive Director Allen Schaeffer following the U.S. Senate’s passage of S. 2195.

View ArticleMOL and TotalEnergies sign time charter contracts for 2 newbuilding LPG-fueled LPG carriers

Mitsui O.S.K. Lines, Ltd. today announced that through its group company MOL Energia Pte. Ltd., it signed a time charter contract for two liquefied petroleum gas (LPG) dual-fuel very large…

View Article

Biden-Harris Administration announces $71 million investment to advance American solar manufacturing and development

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!