Industrial trucks market to record muted sales in short term, market to rebound strongly projects Fact.MR

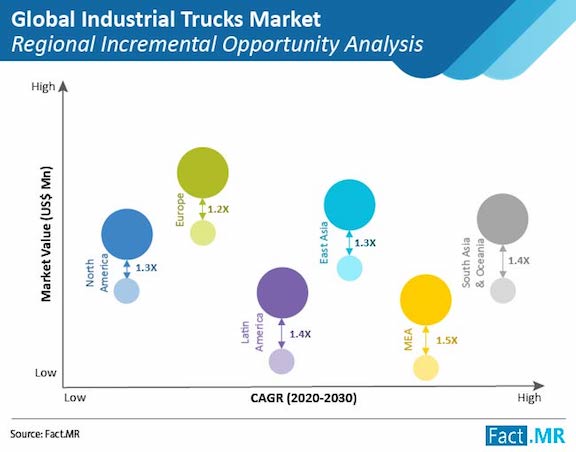

May 27, 2020The global industrial trucks market was estimated to reach a valuation of US$ 20 Bn by 2020 end. However the most visible impact of COVID-19 has been on the automotive sector. Presently sales of industrial trucks have plummeted considerably with manufacturers scrambling to secure some capital or investor money to circumvent the crisis. Despite this, the long term outlook for the industrial trucks market looks good with the market pegged to surpass US$ 37 Bn by the end of the forecast period (2020-2030).

The COVID-19 outbreak has majorly impacted the OEMs and other players in the global industrial trucks market. Multiple end-use industries such as automotive, aerospace, and construction are shut due to stringent lockdowns. This has resulted in dampened demand for industrial trucks. The demand for industrial trucks is at best moderate in the pharmaceutical and chemical industries. On a more positive note, countries like China, India, and Italy have reopened their production plants, resulting in a V-shaped recovery in the industrial trucks market through 2030.

Key Takeaways of Global Industrial Trucks Market Study:

• The electric power source segment is estimated to account for more than 50% of the overall industrial truck sales in 2020.

• In the product segment, the competition will steam up between sit-down and stand-up counterbalance industrial trucks through 2030.

• Industrial trucks below 2.5 tons will continue their foray in the industrial trucks market, gaining 180 BPS in its market share by the end of 2030.

• Europe is foreseen to remain a prominent region, accounting for more than 35% of the global share in the industrial trucks market.

“Globally, industrial trucks sourcing might get dearer due to disturbances within supply chains. Industrial trucks manufacturers will delay new launches by at least a few quarters amidst COVID-19, which in turn will hamper demand prospects of industrial trucks” opines the Fact.MR analyst.

Expansion & Product Launches in Long Term to Spur Regional Hegemony

Fact.MR reveals some of the key renowned players in the industrial trucks market such as Raymond Corporation, Komatsu Ltd., Kion Group AG, Jungheinrich AG, Hyster-Yale Materials Handling, Inc., Toyota Industries Corporation (TICO), Crown Equipment Corporation, Godrej, Doosan Industrial Vehicle Co. Ltd., and others. The companies are emphasizing on seeking new orders from emerging countries along with the launch of new products to cater to the demand from end-users. For Instance,

• In 2019, Jungheinrich AG launched the latest version of its extra slender electric tow tractor, the EZS 130 at InterAirport. With a width of merely 600 mm, the truck is designed to be a space-saving tagger train for the maneuverable transportation of small parts.

• In 2019, the Hangcha group launched a series of medium-level order pickers with a total load capacity of 1100 lbs. The company launched this product specifically for the American market to collect new orders and generate sizeable revenue pools.

• In 2019, Kion Group AG pursued its growth strategy with the construction of a new industrial truck plant in Ko?baskowo, near Szczecin, Poland. The additional plant in Poland will complement the existing production facilities of the KION Group across Europe.

Find More Valuable Insights on Industrial Trucks Market

Fact.MR, in its new offering, provides an unbiased analysis of the global industrial trucks market, presenting historical demand data (2015-2019) and forecast statistics for the period, 2020-2030. The study divulges compelling insights on the industrial trucks market on the basis of product (Hand Truck, Pallet Jack, Walkie Stacker, Pallet Truck, Platform Truck, Counterbalanced Lift Truck, Reach Truck, Turret Truck, Order Picker, Order Picker, Tow Tractor, Personnel And Burden Carrier, Personnel And Burden Carrier), power source (Electric, Conventional (IC Engine), Manual), capacity (Below 2.5 Tons, Below 2.5 Tons, Below 2.5 Tons), and end use (Logistics, Retail, Manufacturing) across seven major regions.

Similar Stories

NCCC announces tentative national agreement with SMART-MD

View Article

Savannah container volumes up 10 percent in October

View ArticleNorfolk Southern to add new independent director to board via cooperation agreement with shareholder Ancora

Norfolk Southern Corporation ("Norfolk Southern" or the "Company") today announced that it has entered into a cooperation agreement with Ancora Holdings Group, LLC (together with certain of its affiliates, "Ancora")…

View Article

NationaLease salutes outstanding achievement and service at the 2024 Canadian Leadership Summit

View ArticleBear Cognition launches AI-powered LTL revenue optimization system, maximizing efficiency and margins for 3PLs

Bear Cognition, a leader in intelligent data solutions, has announced the launch of its LTL Revenue Optimization System, a transformative AI-driven platform designed to revolutionize less-than-truckload (LTL) logistics operations.

View Article

Alterra IOS, ARCO develop Charleston industrial outdoor storage site for leading liquid bulk services provider

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!