Funds have stretched the long positions on wheat; Soybeans lead the Phase 1 deal purchase

Oct 28, 2020Corn

• CBOT corn has been following wheat higher, with worrisome northern hemisphere planting weather pushing up the wheat/corn spread. Funds have stretched the long positions on wheat.

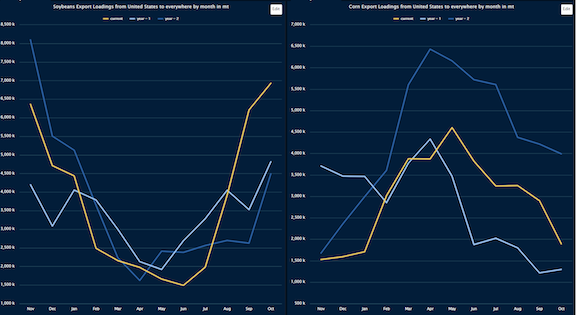

• Corn loadings remained lackluster out of South America and Ukraine, while US stood to benefit, although loadings in recent weeks stayed range bound. With higher than normal % of the USDA estimated corn exports sold, it suggests the US corn exports could be underestimated by the USDA. So far, we have not witnessed US corn loadings to Brazil, despite the recent removal of import tariffs.

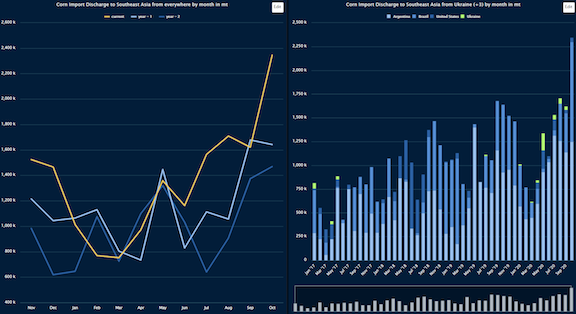

• Global corn offtakes recovered in October after a poor September, mainly led by strong US loadings at the start of the 20/21 crop year. Stronger offtakes in Southeast Asia suggest sustained feed demand, limited domestic production and feed wheat supply.

• Chinese corn imports remained upbeat despite shrinking import margins, though corn is increasingly priced at a premium to wheat, leading to feed wheat substitution and wheat imports.

Soy

• Major origin soybean loadings for October were higher YoY, led by the US, which more than offset South American bean and meal loadings.

• Protein offtakes for regions outside of China were generally lower YoY, a trend witnessed starting September as the transition months between South American and US programs saw weak loadings as a result of the supply pinch felt in South America, aided by continuously weakening currencies.

• China has so far committed more than 71% of the Phase 1 agricultural purchase in dollar values. Based on the current USDA crop year US export estimate, more than 75% of the crop year target has been sold, a pace only surpassed by 2013/14. Though 13/14 saw final export higher than the initial target by 20%.

• China has taken up roughly 55% of US bean sales, above the pre-trade war levels of 50%. While overall US bean exports are estimated at a record, this indicates the US supply available for the rest of the world is capped, especially given the projected tight US bean carry-out for 20/21.

• Anticipated late Brazilian bean harvest in 2021 due to planting delays, coupled with a lower carry-in, has led to the concern of supply in 2021, which has kept the premiums in CBOT.

Wheat

• Global wheat offtakes out of China were weaker YoY in October, following a lower Q3, suggesting the world is still largely going through the pipeline as a result of the stocks building from the first half of 2020, led by Middle East and sub Sahara Africa.

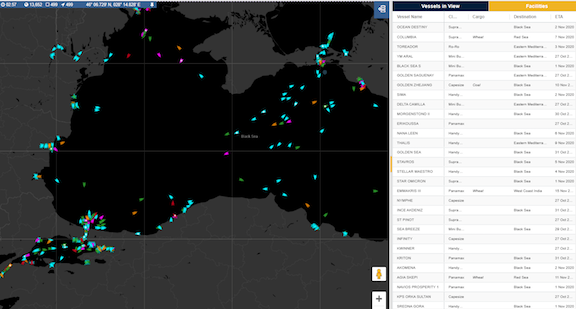

• US exports slowed precipitously while Canada dominated the hard wheat export space. Black Sea exports remained upbeat, which coupled with a weaker ruble, has led to surging domestic price and talks of an export restriction later in the 20/21 season.

ª While Southern hemisphere crop is less than a month away from harvest, the Argentine crop size is lower YoY, hence not expected to shift demand in a significant way. On the other hand, Australian wheat traded at competitive levels, drawing demand away from the Northern hemisphere.

Similar Stories

December 2024 U.S. Transportation Sector Unemployment (4.3%) Was the Same As the December 2023 Level (4.3%) And Above the Pre-Pandemic December 2019 Level (2.8%)

View ArticleDP World appoints Jason Haith as Vice President of Freight Forwarding for U.S. and Mexico

DP World, a global leader in logistics and supply chain solutions, has announced the appointment of Jason Haith as Vice President, Commercial Freight Forwarding – U.S. and Mexico, effective immediately.…

View Article

Amaero secures final approval for $23.5M loan from Export-Import Bank

View ArticleU.S. Bureau of Labor Statistics employment situation

Total nonfarm payroll employment increased by 256,000 in December, and the unemployment rate changed little at 4.1 percent, the U.S. Bureau of Labor Statistics reported today. Employment trended up in…

View ArticleImport Cargo to remain elevated in January

A potential strike at East Coast and Gulf Coast ports has been avoided with the announcement of a tentative labor agreement, but the nation’s major container ports have already seen…

View ArticleS&P Global: 2025 U.S. transportation infrastructure sector should see generally steady demand and growth

S&P Global Ratings today said it expects activity in the U.S. transportation sector will continue to normalize in 2025, with growth rates for most modes of transportation slowing to levels…

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!