[Freightos:Coronavirus uncertainty continues as recovery is slow

Feb 18, 2020The effects of the coronavirus outbreak continued to reverberate across the global supply chain this week, as China took its first but slow steps back to work and uncertainty persists throughout the industry.

Freight rates across lanes fell moderately as demand remains minimal. A further discounting of rates may be unlikely as dropping prices can’t attract shipments that simply aren’t there - the ships that did sail this week reported up to 90% unused capacity.

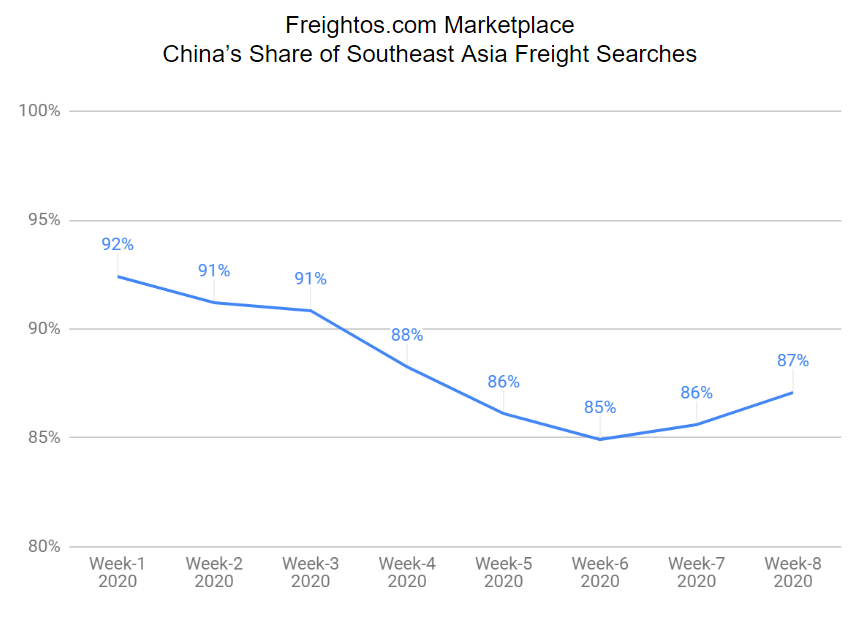

The partial resumption of work and beginnings of production are generating some initial signs of hope, though. Freightos.com’s marketplace data saw a 2% uptick in China’s share of searches for freight bookings out of Southeast Asia for the first time since the outbreak, indicating that some shippers have or are anticipating orders that will be ready soon (chart below)

.

But aside from areas still officially shutdown, the resumption of work has remained slow even in the cities and provinces that are back from the extended holiday. Some factories are waiting to reopen out of fear that the close quarters in factories and dormitories could lead to more infections.

Only about 10-20% of factories have received permits to reopen so far and though transportation within most provinces is back to normal, travel between provinces is still limited, which will also add to the slow recovery.

Eytan Buchman, CMO, Freightos

Similar Stories

Stena RoRo takes delivery of the battery hybrid vessel Guillaume de Normandie

View Article

Indian Register of Shipping reflects on 2024 and sets ambitious goals for 2025

View Article

Yang Ming announces 2025 Trans-Atlantic services

View Article

Exclusive interview with AWO’s Jennifer Carpenter

View ArticleMSC GRI - scope: USA to Bahamas

MSC Mediterranean Shipping Company Co. (USA) Inc has filled and will implement a GRI with below quantum, scope, and effective date for all DRY and Reefer containers as follows:

View ArticleMSC GRI - scope: ISC/ME - Import Indian Subcontinent/Middle East to USA

Mediterranean Shipping Company has filed and will implement the following GRI - General Rate Increase effective January 20th, 2025, as below.

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!