FIS Air Freight Report May 26, 2020

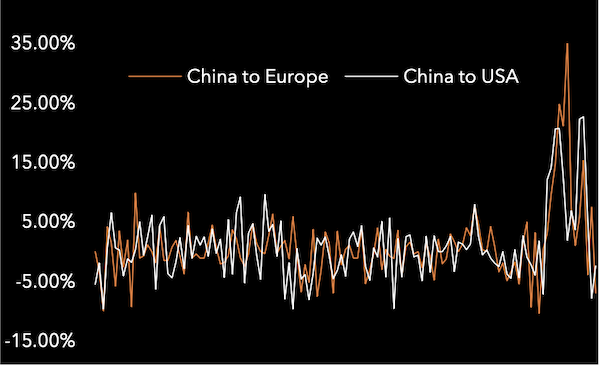

May 29, 2020China to Europe and China to USA continues to slide, however, the rate of descent is in sharp contrast to its previous climb, noted by the near-neutral position of our rate change oscillator. Europe is down 59 cents, USA down 23 cents.

Rate drops would have been sharper if it wasn't for supportive price action in Hong Kong (particularly from Hong Kong to USA, up $1.14). Shanghai drags down the baskets, down $1.37 in Europe and down $1.60 in USA.

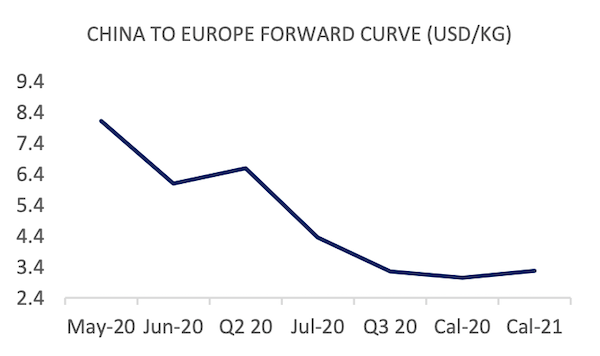

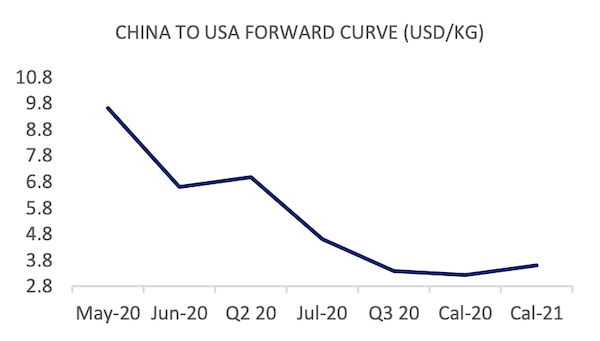

The front-month is lifted with the final settlement prices of $8.12 and $9.62, against the MAY MTDs. The June 2020 offers lift China to Europe up 32 cents, however, China to USA drops off 40 cents. July 2020 is lifted 20 cents by equal bid-side interest on both lanes, set at $3.20.

Market Comment

Whilst core trade lanes start to slip in terms of price, the near future of this market remains uncertain as ever. Much is being touted about an on-coming C-Check of freighter equipment (a 1-2 week inspection of individual aircraft). The interval for B747-400 typically occurs after 6,000 flight hours or 18 months. In other words, 200 to 220 round-trip flights from Europe to China and back.

The implication is that the time frames for this check have been expedited, threatening to take capacity out of the market in the coming months. This isn't really known or guaranteed and ignores the impacts of phased checks or even oncoming D checks (Heavy Maintenance) that are due for a number of B747-8Fs currently flying in the market.

The second unknown is the scale of passenger demand, and thus the availability of belly capacity. The reluctance of governments to engage in open air-bridges, and the asymmetry of quarantine measures, fix the stopper on passenger travel for the near future.

The third unknown, is the impact and size of consumer demand as 'non-essential' economies start to return from mid-June onwards. Inventories will either have to react to high demand, thus causing a sharp, high-speed volume spike. Or, demand will slump in line with a recession, and cargo will move on slower transport modes (container, rail), or not at all.

Diversification and Just-in-Case supply chain developments increase the volatility of prices in the future, something that shippers will have to factor when trying to establish 'traditional' long term contracts.

| Basket | USD/KG | CHANGE | CHANGE % | MTD | VOL % |

| CHINA - EUR | 7.89 | -0.59 | -6.96% | 8.12 | 83.81% |

| CHINA - USA | 9.18 | -0.23 | -2.44% | 9.62 | 71.39% |

| Blended | USD/KG | CHANGE | CHANGE % | MTD | VOL % |

| PVG/EUR | 9.81 | -1.37 | -12.25% | 10.36 | 108.62% |

| HKG/EUR | 5.96 | 0.19 | 3.29% | 5.88 | 68.93% |

| PVG/US | 10.82 | -1.60 | -12.88% | 11.37 | 91.71% |

| HKG/US | 7.54 | 1.14 | 17.81% | 7.88 | 90.84% |

| Global | USD/KG | CHANGE | CHANGE % | MTD | VOL % |

| Air Index | 5.60 | -0.23 | -1.76% | 2.27 | 49.63% |

Forward Curve - Indicative Update

| FIS AFFA, CHINA - EUROPE | USD/KG | ||||

| BID | ASK | MID | CHANGE | |

| May-20 | 8.12 | 8.12 | 8.12 | 0.62 |

| Jun-20 | 4.00 | 8.20 | 6.10 | 0.32 |

| Q2 20 | 5.00 | 8.18 | 6.59 | -0.01 |

| Jul-20 | 3.20 | 5.50 | 4.35 | 0.10 |

| Q3 20 | 2.50 | 4.00 | 3.25 | 0.00 |

| Cal-20 | 2.60 | 3.50 | 3.05 | 0.00 |

| Cal-21 | 2.50 | 4.05 | 3.28 | 0.00 |

| FIS AFFA, CHINA - USA | USD/KG | ||||

| BID | ASK | MID | CHANGE | |

| May-20 | 9.62 | 9.62 | 9.62 | 0.37 |

| Jun-20 | 4.00 | 9.20 | 6.60 | -0.40 |

| Q2 20 | 4.50 | 9.45 | 6.98 | -0.37 |

| Jul-20 | 3.20 | 6.00 | 4.60 | 0.10 |

| Q3 20 | 2.50 | 4.25 | 3.38 | 0.00 |

| Cal-20 | 3.05 | 3.40 | 3.23 | 0.00 |

| Cal-21 | 3.10 | 4.10 | 3.60 | 0.00 |

Similar Stories

IBA forecasts 25% increase in airline RPKs by 2030

In its January 2025 Market Update webinar, IBA’s experts forecast that RPKs will rise from 9.5 trillion in 2025 to 11.9 trillion in 2030 – an expected average annual growth…

View Article

2024 marks record air cargo year for Vienna Airport

View Article

“BelugaXL” as a guest at Munich Airport

View Article

Lufthansa Cargo appoints new executives for Europe and Middle East, Africa & South Asia & CIS regions

View Article

WorldACD Weekly Air Cargo Trends (week 2) - 2025

View Article

Manufacturing as fast as the supply chain will allow

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!