FIS Air Freight Report April 14, 2020

Apr 14, 2020AFFAs trade against the period average (i.e. average of April 2020, Q2 2020, Calendar year (CAL) 2020)

Trading Interest

We have the following trading interest -

BIDS required for the below:

- OFFER APR 20, China to USA, $6.04

- OFFER APR 20, China to Europe, $6.45

- OFFER CAL 20, China to USA, $3.40

Trading Update

Hong Kong to Europe sees a sudden drop-off in rates, down 45 cents to $4.66, however this move has not been significant to dampen a 44 cent climb in China to Europe, now at $6.66. Shanghai to Europe continues to surge, up a further $1.32 to $8.65. Last physical offer seen for $8.88 for scheduled flights next week.

China to USA appears to bounce, up 40 cents however retaining single digit growth percentages. Again, this is largely on the back of a surging Shanghai export price, up 57 cents.

As a result, the front month offers have been lifted to $6.45 and $6.04 respectively, lifting up the rest of the Q2 prices through to June. Bids will have to increase in order to trade the very high market.

Market Comment

The sudden capitulation of Hong Kong prices comes as news of PPE shipments from mainland China are being forced through mainland airports, rather than trans-shipped through capacity out of Hong Kong. Chaos has apparently ensued as the Chinese government clamps down on not fit-for-purpose equipment being bought with blank cheques by anxious governments.

All the while, overall cargo volumes have seen around a 19-30% drop year-on-year, leaving the market very little to fall back on if and when the flow of PPE and other medical equipment dries up. Talk throughout most markets has been that of post-COVID recession, however recent buying sprees at re-opened stores in China (and some in the West) gives us hope for downstream demand.

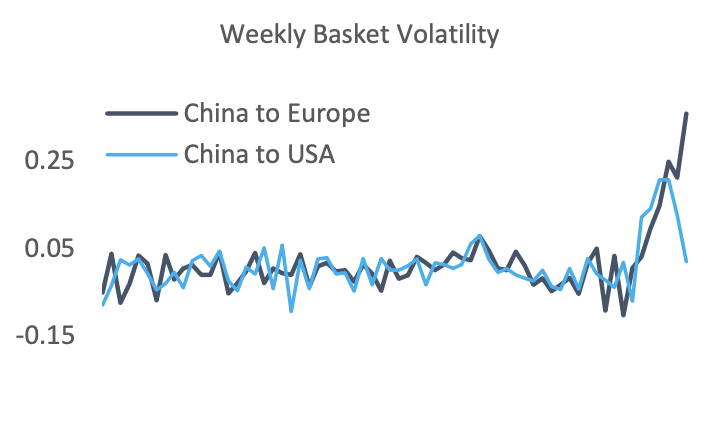

As ever, turbulence ahead remains unforeseeable, and much will rely on the quick thinking, adaptability and agility of freight businesses. We believe the long term market will start to see the suitability of fixed rate long term contracts questioned again, as they were as recently as 2019. For the most part this is driving interest in Index Linked Agreements and rate hedging as a means to offer contract security to both buyers and sellers throughout an uncertain forward market.

Meanwhile, Amazon Air Europe is on the horizon.

| Basket | USD/KG | CHANGE | CHANGE % | MTD | VOL % |

| CHINA - EUR | 6.66 | 0.44 | 7.07% | 6.44 | 92.82% |

| CHINA - USA | 6.23 | 0.40 | 6.86% | 6.03 | 64.96% |

| Blended | USD/KG | CHANGE | CHANGE % | MTD | VOL % |

| PVG/EUR | 8.65 | 1.32 | 18.01% | 7.99 | 118.62% |

| HKG/EUR | 4.66 | -0.45 | -8.81% | 4.89 | 76.30% |

| PVG/US | 6.92 | 0.57 | 8.98% | 6.64 | 97.69% |

| HKG/US | 5.55 | 0.24 | 4.52% | 5.43 | 52.28% |

| Global | USD/KG | CHANGE | CHANGE % | MTD | VOL % |

| Air Index | 4.62 | 0.22 | 4.33% | 2.27 | 49.63% |

| Airfreight Route (AR) | Description | USD/KG | CHANGE | CHANGE % | MTD | VOL % |

| AGR 1 | HKG to LAX & ORD & JFK | 5.84 | 0.06 | 1.04% | 5.81 | 35.00% |

| AGR 2 | HKG to LHR & FRA & AMS | 4.28 | -0.82 | -16.08% | 4.69 | 31.00% |

| AGR 3 | HKG to SIN & BKK & PVG | 2.03 | 0.10 | 5.18% | 1.98 | 26.33% |

| AGR 4 | PVG to AMS & FRA & LHR | 8.37 | 0.76 | 9.99% | 7.99 | 74.00% |

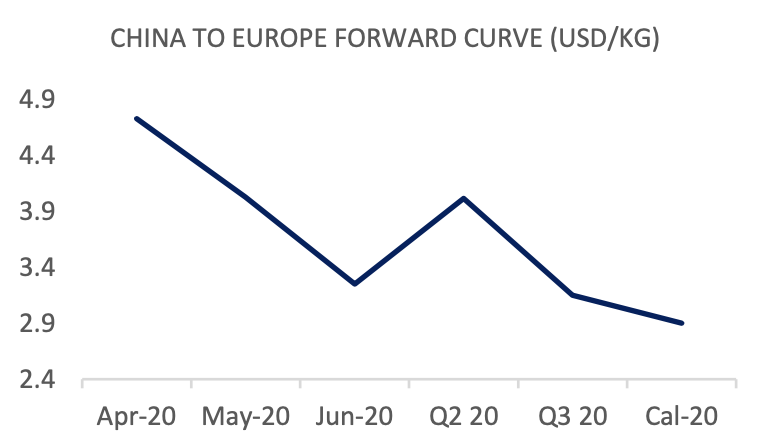

| FIS AFFA, CHINA - EUROPE | USD/KG | ||||

| BID | ASK | MID | CHANGE | |

| Apr-20 | 3.00 | 6.45 | 4.73 | 0.23 |

| May-20 | 2.60 | 5.45 | 4.03 | 0.23 |

| Jun-20 | 2.55 | 3.95 | 3.25 | 0.50 |

| Q2 20 | 2.75 | 5.28 | 4.02 | 0.32 |

| Q3 20 | 2.70 | 3.60 | 3.15 | 0.00 |

| Cal-20 | 2.60 | 3.20 | 2.90 | 0.00 |

| FIS AFFA, CHINA - USA | USD/KG | ||||

| BID | ASK | MID | CHANGE | |

| Apr-20 | 3.71 | 6.04 | 4.88 | 0.25 |

| May-20 | 3.51 | 5.35 | 4.43 | 0.05 |

| Jun-20 | 3.00 | 4.50 | 3.75 | 0.25 |

| Q2 20 | 3.00 | 5.30 | 4.15 | 0.19 |

| Q3 20 | 3.00 | 3.90 | 3.45 | 0.00 |

| Cal-20 | 3.05 | 3.40 | 3.23 | 0.00 |

Similar Stories

Silk Way AFEZCO and FF Construction collaborate to shape the future of Silk Way Cargo Village

View Article

CPaT announces new contract with Romanian based airline, Legend Airlines

View ArticleJAS Worldwide signs SPA with International Airfreight Associates B.V.

JAS Worldwide, a global leader in logistics and supply chain solutions, and International Airfreight Associates (IAA) B.V., a prominent provider of comprehensive Air and Ocean freight services headquartered in the…

View Article

LATAM is once again part of the Dow Jones Sustainability Index

View Article

Aeromexico now connects Miami with Cancun

View Article

WorldACD Weekly Air Cargo Trends (week 50) - 2024

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!