[FBX Weekly] China-US rates even higher and Maersk/Damco merge

Sep 01, 2020Key insights:

- Ocean demand out of China to the US continued to outstrip capacity this week as rates increased again, marking the sixth GRI since the end of May and pushing China-US East Coast rates past the $4,000/FEU mark.

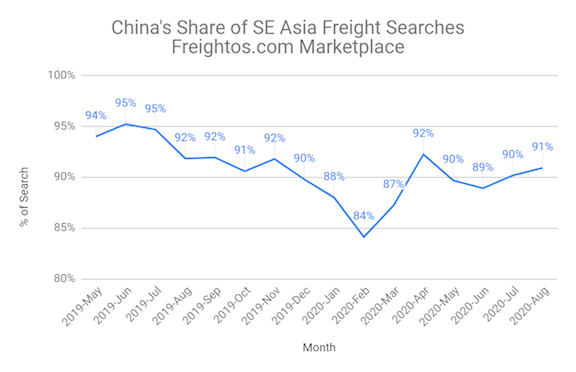

- The pandemic (and trade war) have not reduced US SMB interest in imports from China. Freightos.com marketplace search data show that China’s share of importer freight searches trended down through 2019 to a low of 88% in January. But since the rebound in US imports in June, shippers are focusing on Chinese suppliers again, as China captured 91% of searches in August.

China-US rates:

- China-US West Coast prices (FBX01 Daily) rose 3% since last week to $3,436/FEU. This rate is 113% higher than the same time last year.

- China-US East Coast prices (FBX03 Daily) increased 6% to $4,125/FEU, and are 50% higher than rates for this week last year.

Analysis

Strong peak season demand pushed China-US ocean rates up yet again this week, marking the sixth successful General Rate Increase since the end of May and sending China-US East Coast rates past the $4,000/FEU mark.

As this recent demand surge suggests, anticipation that the trade war and pandemic would lead to a shift away from reliance on Chinese exports hasn’t been realized yet.

Exports from China hit their second-highest monthly total in July, as the government took steps to stimulate the manufacturing sector following the reopening of its economy.

In the months leading up to the pandemic, Freightos.com marketplace search data suggested that US SMB importers were starting to look elsewhere for suppliers: China’s share of searches for freight out of South East Asia dropped to 90% in December 2019, down from 96% the year before.

But since the rebound in activity in June, China’s share of searches has been trending upward, exceeding pre-COVID level by hitting 91% in August. Freightos.com air cargo data had rates out of China declining for the past two weeks after increasing since mid-July. But IATA is projecting an increase in demand in the coming weeks as retailers prepare for the holiday season. WebCargo by Freightos set a monthly record for air cargo eBookings in August possibly reflecting the uptick in demand, and a 13% increase in search volumes for air cargo rates over the last three weeks likewise suggest that bookings will continue to grow in the coming weeks. |

Similar Stories

ZIM launches its USA Employer Brand Campaign to attract top talent

View Article

Hapag-Lloyd achieves good result in first three quarters of 2024

View Article

Decoding alternative fuels: OceanScore supports tricky bunker selection process under FuelEU Maritime

View Article

Wallenius Marine’s new vessel “Way Forward” ready for her first mission

View Article

Dedicated safety advocate celebrates 40-year career

View Article

Potential implications on the freight industry following 2024 U.S election / Signal Ocean

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!