[FBX Weekly] As shippers avoid congestion, Asia-US West Coast rates fall, East Coast prices rise

Mar 17, 2021Key insights:

- A shift from the congested West Coast to the East Coast may be impacting freight rates: Asia-US West Coast ocean rates have fallen 13% from their February peak, while Asia-US East Coast rates have fallen only 5% from their high, and are still 16% higher than at the end of 2020.

- Strong demand on the transatlantic has pushed ocean rates up 20% since the end of January, and an indication of UK-US air cargo demand shows an increase of 30% on searches along this lane since the start of the year, a level maintained since the beginning of February and likely to be helped along by the recent suspension of tariffs.

China-US rates:

- China-US West Coast prices (FBX01 Daily) fell 5% to $4,292/FEU. This rate is 224% higher than the same time last year.

- China-US East Coast prices (FBX03 Daily) increased 6% to $5,716/FEU, and are 125% higher than rates for this week last year.

Analysis

Port congestion and delays are still a problem at the port of LA/Long Beach, and all indications are that there won’t be any meaningful decrease in ocean freight demand in the near future: Though February Asia-US import volumes were down 18% from January, they were still at about the peak pre-Lunar New Year level of January 2020, and March volumes are expected to be up month on month.

But there are reports of it getting easier for shippers to secure capacity out of Asia to the US. Some of this easing may be due to importers shifting orders from LA/LB to other ports, just as carriers are adding new Asia-US East Coast services too.

And spot rates may be starting to reflect that shift. Asia-US West Coast prices have now fallen 13% from their February high, and are just 11% higher than their May-December plateau rate. Meanwhile, Asia-US East Coast rates increased this week. They are just 5% below their January peak, and are 16% higher than they were in December.

Demand on the transatlantic continues to be strong, with ocean rates increasing 20% since the end of January, and the lifting of US-UK tariffs likely to encourage trade on this lane.

And the same trend is taking hold in transatlantic air cargo, where forwarder search volume on WebCargo shows an increase of 30% since the start of the year, a level maintained since the beginning of February.

Similar Stories

Chinese-made Teslas pour into Canada as Biden erects US tariff wall

View Article

CMA CGM: First-quarter 2024 financial results

View Article

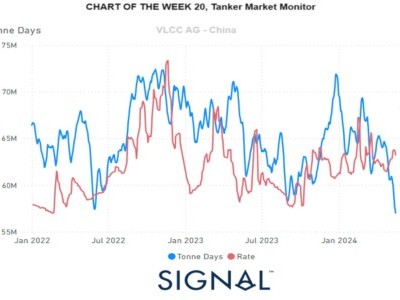

Tanker - Weekly Market Monitor - Week 20 - 2024

View Article

Red Sea disruption is splitting global LNG trade in regions

View Article

MSC Announcement: GRI for USA to Indonesia scope: USA to Indonesia ports

View ArticleMOL and TotalEnergies sign time charter contracts for 2 newbuilding LPG-fueled LPG carriers

Mitsui O.S.K. Lines, Ltd. today announced that through its group company MOL Energia Pte. Ltd., it signed a time charter contract for two liquefied petroleum gas (LPG) dual-fuel very large…

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!