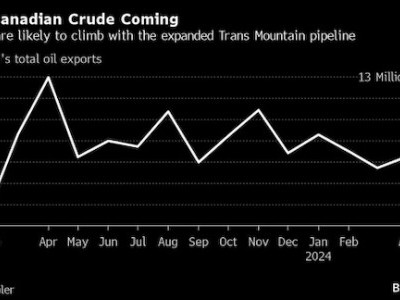

EIA expects crude oil prices to rise through April because of lower OPEC production

Mar 17, 2021

In its March Short-Term Energy Outlook (STEO), the U.S. Energy Information Administration (EIA) expects Brent crude oil prices will average $64 per barrel (b) in the second quarter of 2021 and then fall to less than $60/b through the end of 2022. Higher crude oil prices in March and April are primarily a result of lower crude oil production from members of the Organization of the Petroleum Exporting Countries (OPEC) and partner countries (OPEC+), as announced at their March 4 meeting.

In February 2021, OPEC+ cuts, combined with supply disruptions in the United States, contributed to monthly global petroleum inventory withdrawals that EIA estimates totaled 3.7 million b/d, the largest monthly withdrawal since December 2002. The Brent crude oil futures price averaged $63/b in early March leading up to the OPEC+ meeting, and the OPEC+ announcement put further upward pressure on crude oil prices.

The front-month Brent futures price briefly surpassed $70/b in intraday trading in the days following the announcement, not only because of the announcement but also because of an attack on the Ras Tanura oil facilities in Saudi Arabia on March 7. As a result of the extension of OPEC+ production cuts, EIA expects draws on global petroleum and other liquids inventories of 1.8 million b/d and 0.6 million b/d in the first and second quarters of 2021, respectively.

The sustained OPEC+ production curtailment through April suggests that supply will remain constrained in the near term, even as demand continues to increase. As a result, EIA expects that further inventory withdrawals to meet rising crude oil demand will keep crude oil prices elevated through at least the end of April. EIA’s forecast of downward oil price pressure and increased crude oil availability has several key uncertainties.

The speed of actual demand recovery, based on COVID-19 vaccination rates and the degree to which travel and employment conditions return to pre-COVID norms, remains an important uncertainty on the demand side. At the same time, the degree to which OPEC+ production cuts will continue after April remains a source of uncertainty on the supply side, especially because increasing crude oil prices will encourage OPEC+ participants to agree to production increases in later meetings or to relax compliance with the existing agreement. Finally, the responsiveness of U.S. tight oil production to higher oil prices is also uncertain.

Similar Stories

Iraq stops diesel import deals as refinery upgrades boost output

Iraq halted contracts to import diesel after the upgrade of some refineries helped bolster local output, putting the country on track for fuel self sufficiency.

View Article

California ports gear up to build offshore wind ports

View Article

Red Sea disruption is splitting global LNG trade in regions

View Article

One oil cargo’s odd journey highlights a global market in flux

View Article

Biden-Harris Administration celebrates progress in domestic floating offshore wind

View ArticleEngine Technology Forum calls on House leaders to prioritize action on the Diesel Emissions Reduction Act

The Engine Technology Forum issued the following statement from Executive Director Allen Schaeffer following the U.S. Senate’s passage of S. 2195.

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!