Cushman & Wakefield arranges $125 million financing for fundrise for prominent 1.1MSF multi-market industrial portfolio in Southwest US

May 02, 2024Cushman & Wakefield announced the firm has advised Fundrise, a leading direct to consumer alternative investment platform, in arranging $125 million in financing for a premier industrial portfolio comprising four single-tenant industrial warehouse and distribution assets in the metropolitan statistical areas (MSAs) of Phoenix, Las Vegas and Dallas/Fort Worth. The portfolio is 95% leased to three tenants specializing in third party logistics (“3PL”) and support.

Fundrise assembled the portfolio via four separate acquisitions between February 2022 and June 2023. The portfolio consists of two projects in the Phoenix Metro, including Cubes at Glendale in Litchfield and 8123 South Hardy in Tempe. The remaining two projects include I-215 Interchange in Las Vegas and 4653 Nall Road in Farmers Branch, TX.

A Cushman & Wakefield Equity, Debt & Structured Finance (“EDSF”) team of Rob Rubano, Brian Share, Max Schafer and Ernesto Sanchez represented the borrower in the refinancing transaction. Will Strong of Cushman & Wakefield’s National Industrial Advisory Group (“IAG”) also provided market advisory. The loan was provided by Franklin BSP Realty Trust (“FBRT”).

“This is a prominent portfolio of top-tier industrial products strategically located in some of the country’s most competitive and strongest performing industrial submarkets. The portfolio’s investment profile is supported by strong recent leasing and significant investment by the tenants, with some upside opportunity remaining via bringing the portfolio up to 100% occupancy,” said Brian Share, Executive Managing Director, EDSF. “We were able to structure competitive debt terms in a dislocated market with a great capital source whose view of the credit and opportunity aligned well with Fundrise’s investment thesis.”

“We are excited to continue to expand and strengthen our portfolio in the Phoenix, Las Vegas and Dallas/Fort-Worth markets,” said Ben Miller, Fundrise Co-Founder and CEO. “As a long-term owner and investor, industrial is an asset class we feel particularly optimistic about due to the clear demographic tailwinds and continued expansion of e-commerce. This financing lets us continue to lean into new acquisitions and grow our footprint while much of the market remains on the sidelines.”

The portfolio’s two largest assets (Cubes at Glendale and I-215 Interchange) are newly constructed, state-of-the-art industrial buildings that were recently acquired as vacant forward-sales, which Fundrise successfully leased up during its ownership. The other two assets underwent a strategic repositioning by Fundrise and were improved into best-in-class logistics properties.

Michael Comparato, President of FBRT, added, “Fundrise has been a leading owner and operator of industrial assets in recent years and has been very successful leasing up these well-located assets. We are excited to partner with them and add an industrial loan of this quality to our commercial real estate loan portfolio. We are also pleased to close another loan with Cushman & Wakefield, who has been a valuable client of the firm for a number of years.”

Similar Stories

Ryan Transportation joins top 3PLs adopting Qued’s AI-driven automated load appointment scheduling platform

• Leading freight brokerage and logistics management firm employs new AI-enabled software to automate, streamline load appointment scheduling with thousands of trucking providers. • Leverages Qued’s integration with McLeod TMS…

View Article

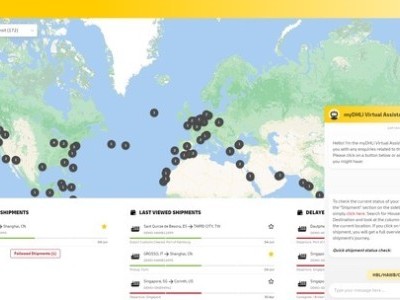

For increased usability and efficiency: myDHLi meets GenAI

View Article

Global supply chain disruptions present challenges and opportunities for the St. Louis Region

View ArticleZIMLog unveils transformed structure pioneering the future of logistics with reliable and personalized precision

ZIMLog, a global freight forwarding brand, proudly unveils its renewed structure, reflecting a blend of experience and innovation aimed at meeting the diverse and evolving needs of businesses worldwide.

View Article

Logistics trade bodies unite in calls for industry action on new EU import declarations

View Article

New digital partnership established between Conqueror and Redkik

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!