Airlines scour globe for capacity as plane shortage takes toll

The massive aircraft deals announced this year — from Air India’s record 470-plane order in February to newcomer Riyadh Air building a large fleet from scratch — are testament to the optimism about a post-pandemic rebound.

But as the surge in travel meets a dearth of available jets, more airlines are scouring the globe for fill-in purchases to sidestep the endless wait lists for new aircraft.

Alaska Air Group Inc. is in the process of offloading its modest fleet of 10 Airbus SE A321neo jets. Among the most popular models and therefore the hardest to get, the aircraft have drawn interest from multiple prospective takers, led by American Airlines Group Inc., according to people familiar with the matter. Other carriers, as well as leasing companies, have also expressed interest, the people said, asking not to be identified as the discussions are confidential.

American Airlines declined to comment.

The used-jet scavenger hunt is the result of an out-of-kilter industry, where demand far outstrips supply of airliners that are becoming increasingly difficult to find. Airbus’s wait list for its most popular single-aisle jets is bumping up against the next decade, and Boeing Co. also doesn’t have anything available in the next few years. That scarcity has only been exacerbated by supply-chain disruptions that have weighed on output and delayed deliveries, making used aircraft an attractive alternative.

“The slower-than-anticipated recovery in new production has meant that any spare or available capacity in the young and new build narrow-body fleet is being quickly absorbed,” said Eddy Pieniazek, head of advisory at aviation finance data provider Ishka.

Boeing Chief Executive Officer Dave Calhoun cautioned in May that the aerospace industry could suffer from supply disruptions for more than half a decade. Component shortages have restricted output, and Calhoun said only after the industry has regained what he called stability — a process that will take about a year and a half — can it really ramp up output.

Widebody aircraft, which are more expensive and not as widely flown as their workhorse narrowbody siblings, are also seeing a resurgence. Finnair Oyj last month said it would lease two Airbus A330 planes along with crew to Australian flag-carrier Qantas for two years.

Earlier last month, Deutsche Lufthansa AG snapped up four former LATAM A350s that the Brazilian carrier retired. The German flag carrier has also previously taken A350s used by Philippine Airlines, in addition to its orders directly from Airbus. Air Canada has meanwhile leased two A330s this summer that were previously operated by Singapore Airlines for interim capacity as it waits for the deliveries of its new orders.

The red-hot market for used planes is evident as lessors to Go Air battle to recover their planes after the Indian carrier sought insolvency protection. During the pandemic, leasing companies cooperated with airlines with unpaid rentals that looking to restructure. But with demand sending lease rates soaring, the aircraft owners want to get their planes out to new buyers promising to pay a premium.

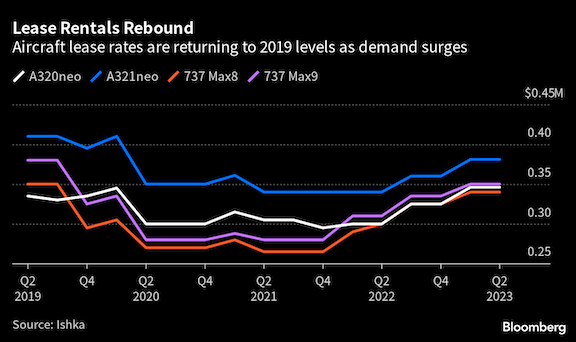

Monthly lease rental prices on A321neos have risen 12% since January 2022 to $381,000, while the Boeing 737 Max 8 is 17% higher at $340,000, according to Ishka data.

Alaska Air is shedding the last of the Airbus fleet it inherited from its acquisition of Virgin America in 2016. The carrier placed its first Boeing 737 Max order in 2012 and has expanded it subsequently. Alaska initially planned to phase out the planes in 2024, but said in April that “September will be the final month we operate the Airbus fleet.”

Similar Stories

Lufthansa Cargo and Maersk launch cooperation to support decarbonization of airfreight

View ArticlePort Authority of New York and New Jersey airports see spookily spectacular surge in October

Port of New York and New Jersey surpasses 700,000 TEUs for eighth consecutive month

View Article

airBaltic Cargo partners with cargo.one to accelerate and enhance its digital sales

View Article

Chapman Freeborn agrees partnership with Portuguese multimodal logistics specialist

View Article

Cathay is ready for the commissioning of the three-runway system at Hong Kong International Airport

View ArticleUnited Airlines Holdings Inc. upgraded To ‘BB’; outlook stable

• United Airlines Holdings Inc. is on track to generate credit measures in line with our previous upside rating threshold this year, and we expect improvement in 2025. • The…

View ArticleGet the most up-to-date trending news!

SubscribeIndustry updates and weekly newsletter direct to your inbox!